This week we are going to cover whether it is possible to trade alongside a full-time job or full-time studies. The aim of this blog isn’t to crush your hopes and dreams of trading part-time to make a side income or to tell you how it is impossible to do this thing alongside other commitments, but I will be honest and transparent. There will be tips and areas to focus on in order to make this goal achievable in the long-term.

The first thing to note is that trading is extremely difficult to master but can also be extremely rewarding, the reason 85-95% of traders fail is down to unrealistic goals at the outset or a lack of discipline to stick to the process. Trading part-time will obviously take you longer to reach consistency than it would if you could devote yourself full-time, but, where that isn’t possible, following the steps within this blog should allow you to build a rigid plan and trading system that will carve the path to success.

Education

Another standout factor to those that fail to achieve anything within this industry is a lack of education or poor-quality education. People have unrealistic expectations that without any education they could be looking at making the same, if not more, than someone who is a qualified engineer with a degree. Most degrees take 3-4 years and even then a lot of jobs will require a masters, another 1-2 years of studying. Why should trading be any different? If it was that easy to make money in the markets without any education, wouldn’t everyone be doing it?

If you want to cut your learning curve in half, then some good quality education is an investment in yourself. You can look elsewhere online but KB offers a fully comprehensive series of education that can take you from a beginner all the way to a consistent trader. If you are new to trading then check out our Trading Forex Beginner Course , if you are a little more experienced in the market then check out our Advanced Trader Course for more specific and detailed strategies. You can also purchase both courses at a discounted price with our Bundle Course option .

Have a plan

Having a plan relates to both a trading plan, consisting of every scenario from trading strategies to your broker’s number in the event of an emergency, and a study plan. Creating a plan for when you are able to study the education and test your strategies is paramount when trying to do this alongside something else full-time, create a realistic schedule of when you can study the markets and stick to it.

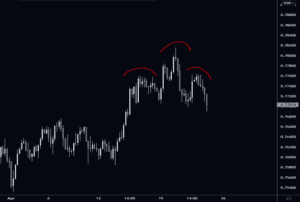

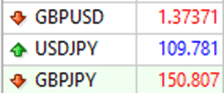

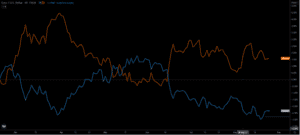

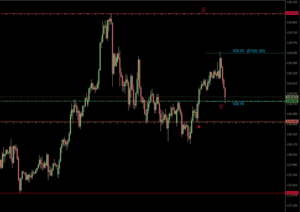

Ensuring you have a detailed trading plan is paramount to success, especially if you are only able to view the markets at certain hours during the day. Tip: You may want to consider implementing higher time frames into your strategy, trading from the daily or even weekly charts to understand your bias and then trading the four-hour chart for execution and management for example. You can’t expect to be able to manage on the 5-minute time frame with full-time commitments elsewhere.

Stick to a consistent strategy

Find something that is simple and easily adhered to, whether that be a strategy from a course or your own. Over-complicating a strategy will only make it impossible to stick to without fail. The simpler the better.

Realistic expectations

As we said at the beginning of this blog, this is the downfall of most people that give up and fail to make it within this industry. Having realistic expectations will keep you grounded.

So, what are realistic expectations?

Especially when learning alongside other full-time commitments some realistic expectations would include the following; trading demo for 12-18 months whilst you learn from the beginning and create a consistently profitable strategy, trading a small live account (funded or personal) for 6-months after this and then growing and/or achieving a larger funded account from here. A realistic goal for any consistent results would be around the 18-months to 2-year mark. Trading demo will allow you to make the necessary mistakes and learn from them without the pain of losing real money or blowing accounts at the beginning of your career and then with these lessons and market experience you will be ready to trade live capital.

Stop Losses

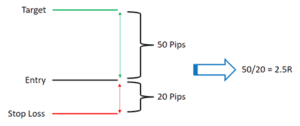

I almost feel that I shouldn’t need to mention this as I would expect this as a given. But, I will delve into this area anyway. Having a stop loss in the market is paramount, especially if you are unable to watch the markets all day. Capital preservation should be the priority of every trader compared to capital gain. The minute you stop thinking of how much a trade could make you and think about what is at risk and whether the risk is worth taking, then you will be that one-step closer to achieving consistency within your trading.

I hope you have found some use in this week’s blog, if you have any questions, you can contact our Facebook page on the website or our Instagram pages.

Until next week, safe trading!

Jake

Recent Comments