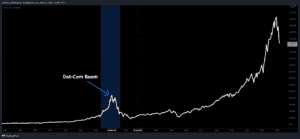

Dot-Com Bubble Chart source:www.marketwatch.com

In-light of everything going on in the crypto space… let’s talk about market bubbles. #btc #ust #eth

Above is a chart of the Dot-com bubble.

Peaking around 2000, this stock market bubble came on the back of excessive speculation of Internet-related companies in the late 1990s.

The problem with a rapid price increase is that it attracts media attention and “hype” from ill-informed investors who steam into the markets to try and ride the wave. This hype usually happens prior to the peak and further drives the price up. At this point, the wise/larger investors begin to take profits, creating selling pressure. Due to the ill-informed nature of the “hype” participants, they are like to exit on any sign of weakness, creating further selling pressure, leading to a crash.

Now if you got in around 1995, by the time we hit 2005, you’ve not lost anything. Likewise if you got in around 2002-2003, you’re alright, the market has peaked and now public perception, faith and interest has waned significantly, offering discounted priced for the wise investor. By the time we get to 2015, those who entered in 02,03 etc have all done really well.

My point: Just because a market has crashed, does not mean it’s dead, or failed. I believe in crypto long term, but this will come with market maturity which means less parabolic moves, and more consistent and sustainable climbs.

P.s. If you buy into an aggressive up move, you’re likely to lose long term.

*NOT FINANCIAL ADVICE*

Until next week, safe trading!

Sam