In the previous blog post we discussed a couple of different price action entries, we also looked at the different ways we can approach these. Whether that be a go-with approach or a retracement etc. This week we are going to focus on inside bars, these can be used as another price action entry and can also form a daily bias.

We will cover the following today:

- Inside Bar (Inside Day)

- Inside Bar Failure (Inside Day Failure/ Inside Hour Failure)

Inside Days

Inside Days are a daily pattern involving two daily candles, we have a day of trade, also known as the ‘mother candle’ and then the following day trades the whole day within the range of the previous day. This is a two-day bias suggesting a potential reversal. A great way to play these sorts of biases is to pre-empt the failure of this reversal, as well as playing the success of the inside day, so what does this look like? Let’s take a look at an example below.

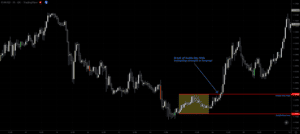

In the following example we can see that the inside day occurs within a strong impulsive down move, this could suggest that we may see a reversal to the upside.

Let’s move onto the hourly time frame and take a look at the potential reversal.

We can see here that as soon as we get a break of structure, and a break of the inside day high, we see that conviction and strength of the reversal in a continuation to the upside. This is an example of a successful inside day, however, we must also be aware that these can easily fail. Therefore, price may fake out of one side, react from some significant structure and then proceed to reverse and take out the opposite extreme of the inside day. This takes us onto inside day failure and subsequently inside bar/hour failures.

As we have seen, with a successful inside day play, a lot of people are looking for that reversal of the down move after we print an inside day. We can use this approach on the lower time frames to predict trapped participants in the wrong direction.

In the second part to this post we are going to focus on using inside hour failures as a form of price action entry confirmation.

In this example we will be looking at a daily bearish engulfing giving us a short bias, next we need to head onto the lower time frame, in this example this will be the hourly time frame. For our entry confirmation.

After our daily bearish engulfing it is the inside hour failure that provides us with a nice entry to play the continuation of this engulfing. A simple way to approach this price action entry confirmation is to execute at market.

To summarise what we’re looking for with this type of price action what we want to see is an hour spent within the previous hours range, followed by a break of the upper extreme (i.e. a fakeout) before closing the hour back within the range of the inside bar (if looking for shorts, vice versa for longs).

Hopefully you can take some useful tips away from this, if you have any questions consider joining the KB Community and learning with us!

Until next time,

Jake