Not all trades are executed with a pending limit order, we have spoken about the different types of orders in a previous blog post so if you’re unsure about the difference between a limit order and a stop order go check that out first. This week we will be focussing on what price action constitutes a valid entry signal and we will look at the variations of how we play these. The following examples will show you how you can play each of these entry confirmations, it is up to you to backtest each approach and take the one that fits best to your style of trading. Entries which require market execution are more aggressive and may not be your trading style, whilst others are more conservation and play on momentum, let’s take a look.

The two price action entries we will be looking at today include;

- Bullish/ Bearish Engulfing

- Shooting star/ Hammer (+ thrust away)

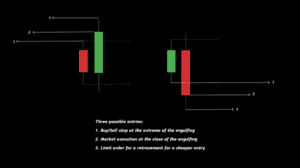

Bullish/ Bearish Engulfing

The dotted grey lines highlight the range of the previous candle, why? Because for it to be an engulfing it must take out one extreme of the previous candle and then close beyond the opposite extreme, i.e. completely engulfing the previous candle.

The more aggressive approach here is to execute at market at the close of the engulfing. A more conservative approach would be to place a stop order at the extreme of the engulfing, this way you will be filled with the momentum of the market in your direction. If you are looking to get that cheap entry and increaser your R, however, you may be looking to opt for a short retracement to the naked high/low prior to the engulfing.

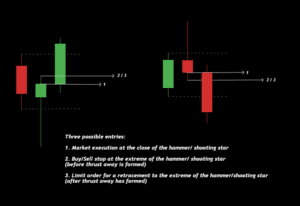

Shooting star/ Hammer (+ thrust away)

Why have I placed the thrust away in brackets? Simply because it is your discretion whether or not you wait for a thrust away after each of these price action entries. Waiting for a thrust away adds another layer of confluence, confirming the price action but at the same time this approach is a lot more conservative and you may miss out on some trades. Again, there are three options for hammers and shooting stars with regard to our entries.

Again, the dotted grey lines highlight the range of the previous candle, why? Because for it to be a hammer or a shooting star it must take out one extreme of the previous candle and then close back within the range of the previous candle.

Just as with the engulfing price action entries the more aggressive approach is to execute at market at the close of the hammer/ shooting star. A more conservative approach would be to place a stop order at the extreme of the hammer/ shooting star, this way you will be filled with the momentum of the market in your direction. If you are looking to play it safe, however, you may find it best to wait for a thrust away to confirm the price action and then opt for a limit order at the extreme of the hammer/ shooting star.

These are a couple of the simpler price action entries we trade, all of which offer multiple entries depending on your trading style, on another occasion we will take a look into inside bar failure in more detail as a means of price action confirmation. If you’d like to check out our education where you can get an in-depth look at how we trade, check it out here.

Until next week, safe trading!

Jake