Trading Flag Patterns

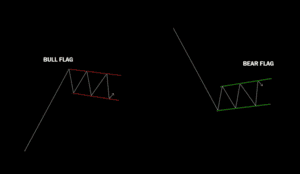

This week we are going to take a look at another well-known retail trading pattern. Like many of these patterns it’s knowing when to execute them that plays the significant factor within the success rate rather than the pattern itself working every time. The two types of flag patterns we will focus on today are of course the bullish flag pattern and the bearish flag pattern. These patterns are simply an impulsive move in one direction, followed by a period of consolidation before the second impulsive move in the same direction.

What we can see from the diagram above is a bullish flag pattern and a bearish flag pattern, however, a key point to note within these patterns is how the period of consolidation is actually counter to the trend. Within our ‘Bull Flag’ we have an impulsive move to the upside and then a period of consolidation where the market is making lower lows and lower highs, and vice versa for our ‘Bear Flag’. This is a very important factor to note during these flag patterns.

So, how do we trade these?

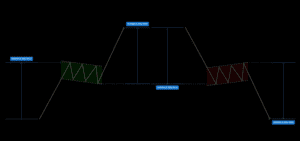

Flag patterns have a high probability of duplicating the first impulsive move on the second leg. We can, therefore, measure the distance of the impulse move and duplicate this for the second impulse. See diagram below.

In this example, the impulse move was 433 pips, we can therefore have a target of 433 pips from the low of the consolidation period of the flag pattern.

A simple way to trade these patterns is to wait for a break and retest of structure within the consolidation period, with a stop below the low of the consolidation and using our target of the initial impulse move. See example below, vice versa for a bearish flag pattern.

This is a fairly simple but effective market pattern trading with the trend and trading with momentum can often lead to quicker resolutions. This has been a sneak peek into the Advanced Trader Course , details on specific strategies are covered within the course if you would like to cover these aspects in more depth.

Until next week, safe trading!

Jake