Welcome back to another week, this week I am going to dive into the nitty gritty aspects of trading that people neglect but I believe could be having a huge negative impact on their trading for not knowing it.

This week we will be focussing on the different types of orders that can be placed in the market and when to account for spread.

Different type of orders in the market

An easy way to understand the different types of orders in the market is through this helpful diagram below.

A stop order is placed when you want price to continue in the same direction when it fills you. Whereas a limit order is when you want price to reverse and trade in the opposite direction once you’re filled. We will take this into more detail in the examples below.

When and where do we need to account for spread?

Think about this logically, spread is created by the brokers providing you with a bid price and an ask price so they will always have it better.

Think about it in this extreme example:

- You’re wanting to buy/sell something that is worth £10

- Your broker says they will let you buy it for £11 or sell it at £9

The spread here is £2, if you buy this “asset” right now and you sell it back to the broker straight away you will be buying it at £11 and selling it at £9, making a loss of £2. This is how spread works in the markets.

You will always be making a loss if you make the exchange straight away in both directions so this should help when you think about which price you will be executed at as if you think you can be filled and exit the trade straight away in a small profit, you’re wrong… unfortunately.

Now we can look into the different orders in the market and where spread comes into play here.

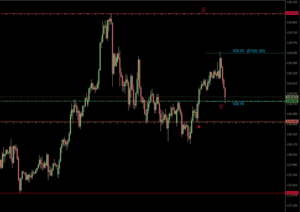

Look at this trade example and we can talk about each of the orders in the market.

The green line in this example is our entry, the orange line is our stop and the red line above market is our target. All of these are individual orders in the market, so what are they?

The entry = Buy Limit

Why?

Because we want price to reverse once the order is filled, see diagram above.

So, at which price do we get filled?

If we a looking to buy here, and the broker will always make a profit on you if you were to execute in the opposite direction straight away, then you will be filled at the ask price and sell at the bid price.

*Key point to note: The bid price on your chart is current market price. The ask price will be the spread above current market price.

Therefore, the low of the candle in this example would need to push below our order however large the spread is until the ask price line tags our order. If the spread is 3 pips wide, the bid price (i.e. current market price) would have to trade 3 pips below our order before we are filled. How do we combat this? We would place our order at least 3 pips above the price we want to get in at.

The stop loss = Sell Stop

Why?

Because we want to sell back our position at this price as we deem our trade idea to no longer be valid. Remember from the diagram at the start, we cannot place a sell limit below current market price.

So, at which price do we get filled?

For a sell stop we will be filled at the bid price. If this were a stand-alone order without our original buy position, we would be selling at the bid price and buying back our position higher up at the ask price as the broker always has it better.

The target = Sell Limit

Why?

Because we are selling back our buy position and we cannot place a sell stop above current market price.

So, at which price do we get filled?

We will be filled at the bid price. If this were a stand-alone order, a sell limit, we would be filled at the bid because we would be buying back in loss at the ask price as the broker always has it better in immediate transactions.

Conclusion

In a long position we only need to account for spread at our entry. However, in a short position we would need to account for spread at our stop loss and target as we will be filled at the ask price on both occasions, it is only at our entry that we will be filled at the bid.

What does this mean?

This means that in a short position you will have to add spread to where you believe you are wrong, if you don’t, current market price won’t even have to reach your level to take you out of the trade as you will be taken out at the ask price.

I hope this makes sense, if you need any further help and guidance think about joining KB through our Advanced Trader Course , this provides video breakdowns and comes with guidance from myself and the rest of the team at KB, see you soon!

Until next week, safe trading.

Jake