Recently I have had a few enquiries into our daily routines as full-time prop traders. Looking up from the start of the journey as a beginner it can sometimes look a bit daunting and even unachievable to become a prop trader trading full-time. This is something we are trying to change with these blog posts and social media outreach, it enables you to get a sneak peek into our lives and what we do every day and to show you what it takes. This career path takes time and the only way to achieving consistent results is being consistent in your routine. The first ever blog post touched on how to achieve consistency so if you haven’t read that yet check that out here.

Daily Routine

We arrive in the office every morning at 7:15am latest, this requires waking up at around 6am for most of us each day. It is crucial for us to arrive at this time because it allows us to get set up for the day before the London open at 8am. We are able to take a much more objective approach to the markets when they are quieter, this is even more relevant when it comes to market preparation at the weekend when the markets are shut. When price is moving quite aggressively it can be difficult to think rationally and so it is by far one of the most important aspects to our day to be prepared before the London open. Being awake in time, getting showered and dressed, grabbing a coffee and making your way into an office mentally prepares you for the day ahead. Something that can be difficult is working from home, the easy option here is to wake up later, not shower and get ready and even trade from your bed perhaps, this is not preparing you to perform at the highest standard.

Organisation

Organisation is a huge factor that many people neglect. We will have folders organised for each asset we trade, the stats regarding each strategy, our daily plans, our weekly trade reports, the screenshots for the trades we’ve taken, the trades we’ve missed and so on.

It goes even further than just documents, we need to be organised to have the news ready to open at the tap of a button, correlation apps and even our broker information contact details in case anything goes wrong. This can often be overlooked, we deal with enough stress as it is, organisation reduces the stress we can control.

Market Understanding

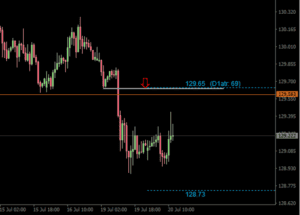

Understanding when the markets you trade are quieter will allow you to plan your day more effectively. Therefore, for most of us trading currencies we know that there will be an increased period of volatility around the London open and then the New York open in the early afternoon UK time. If you are trading Gold you will notice this occur at 13:20 and with S&P 500 for example this will occur at 14:30 due to the cash open. Different assets will vary and so it is important you know the markets you trade in this way.

Up until around 10am we will allow ourselves time to concentrate on the live markets without other distractions, after 10am the markets are usually a bit quieter, this allows us to find some time for edge development. Whether that be gathering data, backtesting a strategy or watching an educational video. We will take breaks every few hours to grab a coffee or some fresh air and get away from the screens, it is just as important to take these breaks as it is to be focussed. We cannot function at 100mph every minute of the day and you shouldn’t be trying to do this either.

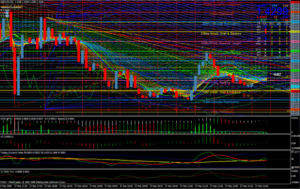

Something to bear in mind is the strategy you trade. We take a top-down approach to our trading (Weekly -> Daily -> Hourly) and it is on the hourly time frame where we execute and make our decisions, an important factor to note on this point is that we do not make a decision midway through an hour, so there is often very little benefit to watching the markets every minute of the hour if we are not going to make a decision based on this price movement. Therefore, this allows us to work on our edge development and then look at the markets 5-10 minutes before and after the hourly close to decide if we are going to make a decision.

Final Note

This pattern of edge development, checking the live markets and taking a little break will take us to around 5-6pm where we will finish the day with a review of what went well and what we could do differently to improve even further. Most of us will also go to the gym around this time as this is also another very important factor that people tend to neglect. You need to treat yourself as a high performing athlete, you may laugh at this but this is an extremely high-performance based job. We are up against the best of the best, against people that know 10x more than us, people that have 10x the amount of experience. We are all competing on the same stage, there is no beginner forex market for new traders to test. So, it is important we are doing everything we can to give ourselves an extra edge in the markets. Looking after your physical health will keep you sharp and ready to perform at the highest level you are able to.

A big aspect to remember is that this is a difficult and competitive career choice, you wouldn’t expect to become a judge and be on £250k per year within 6 months of training so why should you think that is the case for a trader?

And on that fairly holistic end to the blog post, stay hydrated and safe trading!

Until next week.

Jake

Recent Comments